Why Offering Multiple Payment Options is Important for eCommerce Businesses

If you've ever ordered something online - and who hasn't at this point - you know that the payment window is the final step before packaging, shipping, and receiving your order. When you reach the payment window, you will usually see multiple payment options, including credit and debit cards, digital wallets, payment services, fintech services, and even checking accounts.

Payment processing online has evolved from the simple days of punching in a 16-digit card number to a world of one-tap purchases, digital wallets, and cryptocurrencies. The simple truth is that by accepting multiple payment methods, you can better cater to a diverse customer base and attract customers who would otherwise be unable to pay for your services. You won't reach your maximum conversion rate if you only offer the most popular payment methods.

Let's dig in and start covering payment methods, the most popular options, and how you can best implement them to maximize your conversions.

What is a payment option?

A payment method is how businesses receive payment for their services or products. While cash is a payment method as well, it doesn't easily apply to eCommerce, so we'll discuss digital payment methods. It's easiest to think of a payment method as handing someone cash, but instead of physically handling a piece of paper, the transfer is made digitally via the banks (in most cases) of the consumer and retailer.

In many cases, using a card or digital wallet can be safer than using cash. Credit cards limit how much a customer is liable for if their card is stolen (for example, when a stolen credit card is charged $500, the customer is only liable for $50; the bank covers the rest before canceling the card). Debit cards are almost always PIN-protected, and digital wallets are password-protected. Once stolen, cash essentially belongs to the thief; there is no way to track its use, detect that it is stolen, or prevent it from being used. In addition to this, it takes up more physical space, so it's no wonder that digital payment methods have largely replaced cash payments, even outside eCommerce.

What are the most popular payment methods?

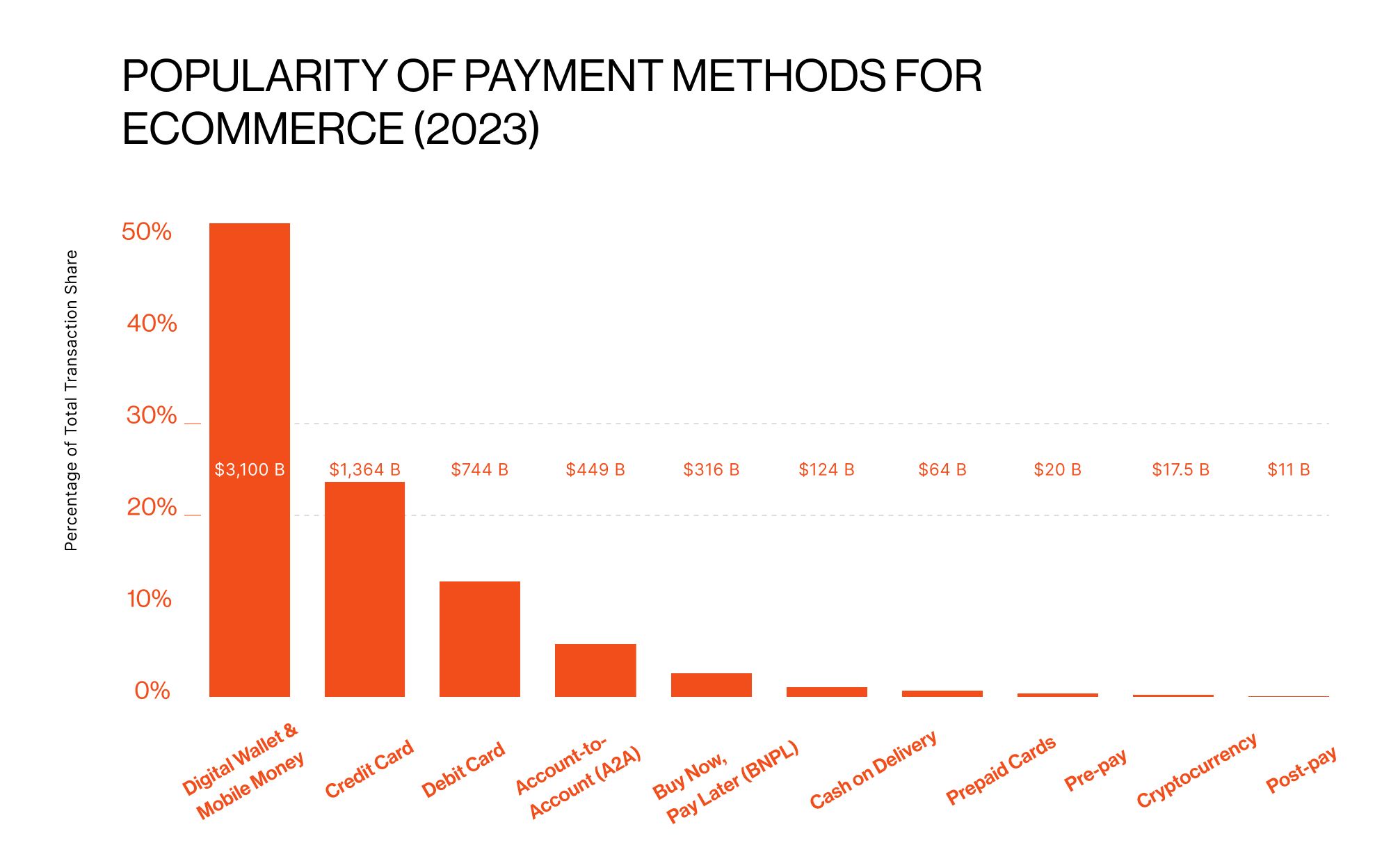

The most popular payment methods change with time. Because of smartphone proliferation and online shopping, digital wallets are the most popular, with over 50 percent of all eCommerce transactions performed with digital wallet services. Nonetheless, consider including as many as you can, as even the least popular methods still amount to nearly 20 percent. Leaving those customers without an option, uncommon as they are, leaves money on the table.

What are credit cards and debit cards?

The most well-known payment methods are credit or debit cards. The payer enters their card number, waits for their issuing bank to approve the purchase, and receives confirmation of the transaction. Bank cards come from many financial institutions, the most common being Visa, Mastercard, American Express, Mir, or China UnionPay.

This type of transaction essentially lets the banks of the payee and the payer digitally exchange financial information in the background. This payment method has been around since the 1950s and has proven resilient to technological advances, though more recently, it has lost its position to digital wallets as the most common eCommerce payment method.

What are mobile and digital wallets?

Digital wallets include services like PayPal, Venmo, and AliPay, as well as mobile payment options like Google Pay, Apple Pay, AliPay, and WeChat Pay. These work slightly differently because they are not issued by banks but still typically use either bank or card credentials to make purchases. Funds are stored in the digital wallet and used (or automatically deducted from a bank card) when the payer makes a purchase. Digital wallets also have the advantage of accepting payments from other individuals or organizations using the service, meaning that, in some cases, the user does not need to rely on a bank card.

Digital wallets are usually encrypted end-to-end, making digital wallets just as safe to use (if not more so) as traditional credit cards. They have become popular through smartphone utilities like tap-to-pay, positioning them as the most widely used of all payment methods globally.

What are A2A, BNPL, and CoD?

Other popular methods include account-to-account (A2A or wire transfer), buy now, pay later (BNPL), and cash on delivery (CoD). A2A functions similarly to a debit card but uses an account number rather than a card number. BNPL is essentially a loan where you receive your purchase immediately and pay the cost later, usually at a markup or with interest. CoD requires the user to pay a courier upon delivery of their purchase.

Many of these methods are leftovers from before digital payments were possible and are not as common as the others, but they will still account for an estimated 15 percent of all US eCommerce transactions in 2023. Consider adding these to cater to the few customers who still prefer to use traditional methods.

What are cryptocurrencies?

The final and most recent type of payment method is cryptocurrencies, which are still relatively rare as an accepted payment method. Cryptocurrencies are separate from traditional banks, and instead, get their value from a shared belief of worth and due to the difficulty of forming new blocks on blockchain tech (known as 'mining'), which cryptocurrencies rely on for security, traceability, and verification purposes. Some of the most popular coins, like Bitcoin, Ethereum, BNB, and Solana, tend to be volatile. However, stablecoins like USDT, USDC, and Dai are tied to real-world currency values, making them popular salary payment methods.

While these methods tend to be rare, enthusiasts and people paid in crypto (an increasingly common practice) may find the option helpful, reducing friction for your buyers. If the option is easy to implement and cost-effective, consider adding it.

How multiple payment options help your business

Multiple payment methods, in a nutshell, maximize conversions, minimize cart abandonment, reduce customer friction, accommodate a broader range of customers, and increase brand loyalty. Customers want to purchase your goods and services with the most familiar method, and including multiple payment methods is often relatively easy. Even if you cannot activate all your desired payment methods at store launch, stay tuned-in to what your customers want through financial news and your visitor metrics (if provided by your eCommerce platform.)

Customer convenience

The most prominent reason for including multiple payment methods is to reduce customer friction. When a customer arrives at the payment window, you want them to see their preferred payment method, click it, and complete the purchase as easily and quickly as possible. If they have to sift through options to find the one they want, 'daisy-chain' payment services to complete a purchase, or encounter any other kind of friction, the likelihood of them abandoning their cart increases by nearly 70 percent.

Conversion rates and sales

By lowering cart abandonment rates through multiple payment options, you can increase conversion rates and work wonders for your sales. Your customers are much more likely to complete their purchase if they can do it in one or two clicks instead of trying to remember their bank password or find their credit card. The less your customers have to do to complete their purchase, the more likely they will go through with a purchase. By providing at least three of the most popular payment methods, you can expect an increase in conversions by up to 30 percent.

Satisfying customer experience

Multiple payment options are also a great way to improve the overall customer experience and increase brand loyalty. Today's online shoppers expect a certain level of personalization, and part of that is seeing their preferred payment method. Studies show that over 60 percent of customers view a brand more positively based on how many payment options are offered. Brand loyalty keeps customers coming back, increases sales, and portrays your brand as high quality, but remember to study what the preferred payment methods are in the regions you're targeting.

Reach a wider customer base

Different regions expect different payment methods. Bank cards, either through digital wallets or direct payments, remain one of the most popular methods in the US. In other regions, digital wallets have become the most popular, while direct payments, wire transfers, and BNPL remain common everywhere. Whether you're trying to break ground in a new region or maintain popularity in your first, consider what types of payments are most common and used to reach the largest number of customers.

Reduce dependency on single payment providers

With the use of payment methods comes a reliance on those services, and services stop working from time to time. Whether because of regular maintenance, service closure, or simply because the terms of service have changed, you may find yourself without access to one or more of your payment options. By offering multiple options, you can reduce your dependency on any one payment provider, meaning that business can continue despite what's happening at your service provider.

Know what payment methods your customers want

So now that you've decided to offer multiple payment methods, it's time to pick the ones you want to implement. You should consider what your customers want to use, but also what is popular in the markets you operate in, what kind of security they offer, and how easy they are to implement.

Start by identifying which payment services operate in your market area. You can safely assume that most bank cards and services like BNPL and CoD are available, but there are going to be digital wallets and payment services that your customers expect. Make sure you include these if they meet your business requirements. Make sure you're thinking a step ahead by considering where you would like to expand in the future. Do your payment services also operate in that area? Answering this question can save you a headache in the future.

Next, consider security. In order to accept credit card payments, your business must comply with PCI DSS so that your customers' payment data is safe. Digital payment services should also offer encryption and have their own security measures in place, especially in the event of a data breach.

Lastly, you should choose payment services that are easy to integrate with your services. That means understanding how a payment service operates hosted payment pages, embedded checkouts, and billing support. They should offer flexible APIs so you can craft the payment experience to your specifications and requirements.

How to approach offering multiple payment methods

Now that you're ready to set up your multiple payment system structure, there are several points to keep in mind during implementation. Here are the main topics to consider:

-

Choose the right eCommerce platform - the platform you choose for your business should support not only multiple payment methods but also the preferred payment methods of your customer base. Ucraft Next, for example, promotes multiple transaction services, including PayPal (which includes Venmo, iDEAL, Bancontact, and more), Stripe, Square, 2Checkout, and standard card payments. Also, make sure that these payment systems work with your CRM system and financial software.

-

Ensure payments are intuitive - No matter which payment services you decide on, they should be straightforward and easy to understand for both the customer and the store. You should be able to quickly look up transactions for the purposes of reporting, customer care, and issuing refunds. A clear payment window will also help increase transparency and customer trust.

-

Payments should work on mobile - We talk about mobile optimization a lot here at Ucraft, and that applies to payments as well. Mobile transactions account for nearly half of all eCommerce transactions, meaning that making your payment service work well on mobile is not optional.

-

Choose something scalable, reliable, and multicurrency - If your business operates internationally or in a region with many currencies, denying customers access based on their type of money is a bad idea. Make sure that you have payment methods that can accept multiple popular currencies and that the service can scale with your operations, especially if you're moving into other regions. Finally, expect that some of your customers will encounter problems with their payments, meaning that choosing payment providers with good customer service is strongly recommended.

-

Test, monitor, and backup as much as you can - Once you have everything set up, stress test the system as thoroughly as you can; it's better to find issues in the beginning rather than during your Black Friday sales. Once everything is running like clockwork, make sure to check in on the backend from time to time to make sure your metrics are adding up. This can also help you understand your sales better for more targeted and efficient marketing campaigns. Finally, back up your system as much as you can. Losing data is always bad, but losing financial information can potentially be catastrophic.

Work with the right eCommerce platform

Whether considering multiple payment options or simply beginning your online retailer journey, working with a quality eCommerce platform is the first step. Your selection should be able to help you design your website, set up metric tracking, operate wherever your customers are, and feature easy payment service integration.

Ucraft Next is an option designed for international online businesses, big and small. It summarily supports multiple payment methods popular in the world's largest online markets. It features established payment method integrations, abandoned cart management, and metrics tracking that can show you how your business is performing, all from one easy-to-use dashboard.

Running a business isn't easy. It requires a significant time commitment, an intimate knowledge of global markets, and detailed customer comprehension. When choosing your eCommerce platform, ease of use and integration with the services you need are the priority, and Ucraft Next is here to help turn your aspirations into the next big online sensation.

Related posts

446,005 entrepreneurs like you already have a head start

Become one of them by getting world-class expertise delivered into your inbox, for free.